We are now entering the greatest inter-generational wealth transfer in history as retiring Baby Boomers begin to sell off their businesses. The estimated value of this transfer is twelve to fifteen trillion dollars. That’s trillion with a “t”.

People often ask what the growth potential is with an acquisitions strategy, so let’s take a look.

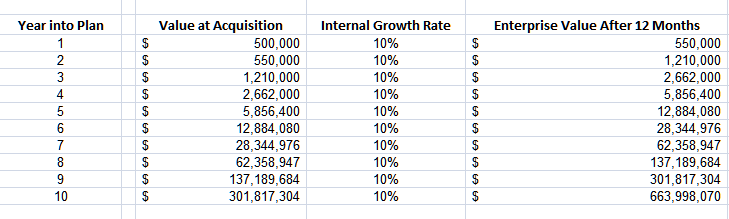

How big could you grow with ten acquisitions over ten years?

Assume that you begin with a single company valued at $500k. Then assume a consistent internal growth rate of 10% every year. On top of that comes the growth from doing a single acquisition per year that doubles your enterprise value.

So how big could your empire grow if you did just one acquisition every year for a decade?

Here are the numbers:

The likelihood of being able to double enterprise size every single year with a one acquisition may be a stretch for you if you are new to this. Therefore, I suggest imagining that in year 9 you doubled your value with two deals and in year 10 with four. However, keep in mind that doubling enterprise value annually with acquisitions is very realistic.

What happens if you cannot implement such a plan? What if you are only capable of achieving one-tenth of this growth rate? Well then, in ten years you would have a collection of businesses valued at around $66,000,000. That’s still not a bad way to retire.

The great wealth transfer will end around 2025 when the final wave of Boomers becomes too old to work.

Will you have something to show for it? Or will it be another missed opportunity?

Continue reading about how to capitalize on this before the window shuts.