Here’s How the Tycoon Playbook Course Will Change You

The tycoon game is about the acquisition of cash flow producing assets. In most cases, these will be businesses. One normally begins with small businesses and then either sticks with them or graduates up to bigger ones. The choice comes down to personal preference. Some tycoons build their wealth through the control of hundreds if not thousands of small assets while others gradually trade them away for control of a handful of larger ones.

Let’s take a look at how the course is constructed. Think of it as having two parts. The first part reveals the tycoon strategy of growth through asset acquisitions and its potential by looking at a number of men who started from humble beginnings and built empires. The second, and much bigger, part drills down into the details of entering the game and how to find, finance, and sell assets. The roughly 1000 page course takes six weeks to complete.

The emphasis of this full stack course throughout is to distill and present actionable lessons from the tycoons.

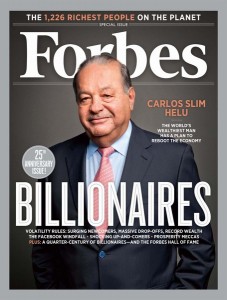

In this module we cover how the course came to be, why serious entrepreneurs need to study tycoons, the tycoon mindset, and a look at two self-made men. One of them is a classic example of someone who went for billionaire status too aggressively all the while ignoring the warning signs. His businesses empire finally imploded. The other billionaire is a man who took empire building one day at a time and did it the right way. He became one of the wealthiest men on the planet.

Why study self-made billionaires and tycoons?

A look at a drive towards tycoon status that imploded.

A look at a drive towards tycoon status that succeeded.

Module 2

Ordinary men avoid trouble. Extraordinary men turn it to their advantage. – HBO’s Boardwalk Empire

The factors that create tremendous opportunity.

Module 3

An entrepreneur who doesn’t know how to use acquisitions is like a boxer in the ring with one arm tied behind his back. – Peter Ireland

In module 3 we unveil the basic tycoon game of asset acquisition and how it accelerates growth to the rates needed if one is to have a shot at qualifying for at least the centi-millionaire club. The module also covers the three stages of growth all must pass through in order to have a shot at tycoon level success. Think of this module as providing the big picture or “the 30,000 foot view,” if you prefer. After this module we will begin to fill in the details.

Introduction of the basic billionaire strategy or “play”.

How to begin attracting the right talent.

Alternative paths into M&A deal-making.

Module 4

If everything seems under control, you’re just not going fast enough. – Mario Andretti

In this module we narrow our focus on bulking up your platform company so that it will qualify for the financing needed for its initial acquisitions. We will cover a broad range of strategies and tactics for accelerating your growth including both white hat and black hat. As mentioned elsewhere on this site the course works best for those who are already running a business. People not running a business currently will have extra work to do before they can enter the game.

How to accelerate the growth of a small company.

Industry as eco-system.

Gaming the system.

Bulking up strategies.

Your first carton of watches.

Slip-streaming: both buy and sell sides.

Feeding the beast.

Piggy-backing.

White knight.

Built-to-flip.

Bandwidth hogs.

Fast-follower.

Consolidations.

Roll-ups.

Keep the back door open.

Module 5

Sometimes you’re treated like a skunk at a tea party. But that’s the fate of anyone who challenges the status quo. – Rupert Murdoch

In the 5th week, we look at how tycoons add value to their acquisitions in order to both improve their valuations and cash flow. We also look at how deal-makers package smaller companies together for resale to larger ones. Finally, we unveil what I call the Golden Feedback Loop. This refers to the fact that tycoons tend to be disruptors of the existing ways of conducting business within an industry. They disrupt by unleashing a new set of rules that change the game for everyone. It then becomes a matter of adapting to their ways or dying. This is how industry dominance is achieved and empires are created. For many grads, this module alone was worth the price of admission.

The various ways to create value by merging small companies.

How to package small companies together in order to entice large corporate buyers.

Creating synergies.

The Golden Feedback Loop.

Barbarians at the gate.

One-stop shopping.

The Turner method.

The bottom-feeder strategy.

Asset-stripping.

Buccaneers and raiders.

Module 6

Everything seemed, as if by enchantment, to prosper under his direction, but it was the effect of system, and nice combination, not of chance. – Vice Admiral Cuthbert Collingwood on Admiral Horatio Nelson’s legacy of designing and implementing systems for the Royal Navy

This module is one of the most popular in the course because it ties together all of the seemingly, at times, disparate topics of the first half. It does so with a case study approach. The case study focuses on the tycoon who offers us the most transferable lessons. While most of us have no hope of copying a Bill Gates, Warren Buffett, or Kirk Kerkorian, this particular tycoon relied on a systems approach to acquiring assets which any business person can copy. Most students find this module an eye-opener and confidence booster. As the old saying goes, from a tiny acorn grows the mighty oak.

How to play Pac Man in your industry.

How to begin building value in your acquisitions.

An example of how to exploit the Golden Feedback Loop.

The importance of systems for every aspect.

How The Tycoon Playbook template can be used across multiple industries.

In the second part we drill down into the details of finding assets, financing them, increasing their value, and occasionally selling them for a profit.

Module 7

You start out as a phony and become real.– Glenn O’Brien

The deal-making community is a small and private one. To the outsider it can seem like a gated community on a private island. In this module we cover how to establish a beach head on this island. The module then moves onto the systems one will need to find their first deals. For most people entering the tycoon game, finding the first deal is the toughest step in the journey.

How the experts find the do-able deals.

How to formulate your own acquisitions criteria.

How to get taken seriously by sellers, brokers, and funders.

How and where to search for the best businesses for sale.

How to everyone in business buying to help you find a deal.

Why you have a huge advantage over the typical business owner and or seller.

Meet some typical small business owners.

Module 8

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. – Warren Buffett.

When one is starting out, capital tends to be scarce, so it becomes imperative to find do-able deals. Module 8 introduces the Do-able Deal filter so that the emerging tycoon can pass on the time-wasters and focus in on the do-able ones. In contrast most business buying rookies try to do the un-doable deal and then quit out of frustration.

How to investigate a business and what to look for in the business financial statements.

Basic financial analysis and valuations.

How to recast profitability for a truer picture.

Why you should politely ignore the seller’s valuation and asking price.

Why the only thing that matters is whether or not it’s a do-able deal for you the buyer.

How to determine if it’s a do-able deal.

Module 9

If you want the lack of money to control your world, don’t worry it will.

Almost everyone dreams about buying a business at some point or another. This I discovered as a business broker. The problem is that very few people understand financing and just assume that the banks are anxiously waiting on the sidelines to throw money at them. They then end up embarrassing themselves in front of the seller and everyone else when they discover that bankers would rather gamble their money at the race track than give any of it to a first-time business buyer. Module 9 covers in detail how tycoons finance the acquisition of assets.

This module has been called the “holy grail of business acquisition financing.”

How business acquisition funding really works.

How to shave the selling price down using deal-maker tactics.

How to raise external funding.

How to raise and use debt funding.

How to raise and use equity funding.

Dozens of financing techniques revealed to help the buyer minimize his personal investment.

How to structure seller financing so that it works for the buyer.

How to leverage suppliers for assistance.

This module will show you how to overcome most cash shortfalls.

The course will show you how to workaround almost any financial challenge.

If you still can’t get financing help after this module, you’re only hope is divine intervention.

Module 10

As through this world I’ve wandered I’ve seen lots of funny men; some will rob you with a six-gun, and some with a fountain pen. – Woody Guthrie

In this module we cover the stages a deal goes through in order to close, deal documentation, negotiating tactics, and the minefield you must pass through in order to have a successful deal. It also covers revolving door deals and death spirals.

How to handle sellers.

How to negotiate.

The sequence of deal steps from start to closing.

The paperwork involved in a deal.

How to present the offer.

Exclusivity & planning.

Due diligence: what it means.

Legal contracts.

Advanced deal structure tricks.

The basic core course consists of the above ten learning modules.

The final two modules are part of the Extras package that comes with the Silver Plan.

Module 11

A million dollars isn’t cool, you know what’s cool? A billion. – Sean Parker, The Social Network

While the game of tycoons is primarily about asset accumulation, sometimes it will make sense to sell off a particular asset or group of assets. This module reveals the tricks of the trade used by M&A advisors and savvy entrepreneurs to fatten the hog up for sale at its best possible price.

How to prepare a business for sale.

The business factors that maximize price.

The most prized revenue models.

The most prized operational systems.

Strategic vs financial buyers.

How to identify strategic buyers.

Module 12

But, the game’s out there, and it’s play or get played. – Omar Little, HBO’s The Wire

This is one of the two biggest modules in the course and contains a wealth of advanced lessons for tycoons not found elsewhere. It covers a few alternative routes into deal-making for those who may not be suited for entrepreneurship. It also covers tapping into the troubled public companies space and how to build deal machines. Most importantly it reveals how tycoons play the game of businesses differently from everyone else. In addition it explains the different types of tycoons so that you can recognize the type you are most likely to be.

More ways to get into M&A deal-making besides buying your own company.

Creating synergies.

Playing the Earnings Arbitrage Game with small private companies.

Playing the Earnings Arbitrage Game with public companies.

Running an “Industry Escalator” model.

Selling deals to public companies.

Advanced strategies & tactics of self-made billionaires.

Tycoon Playbook Extras (for Silver and Gold Plans Only)

The extras include additional details on working with lenders, remote management of assets, and a workbook.

- two addendums on how to raise financing and engineer cashflow post-acquisition,

- a workbook to help you develop a start plan,

- due diligence master checklist,

- and a template for a purchase agreement that can save you thousands in legal fees,

- over 230 questions in a series of interactive quizzes for each module. These quizzes test your understanding of the material as well as help to ensure that your brain is rewired to think like a tycoon,

- a review of your website and game plan for getting into growth via acquisitions,

- X hours of one-on-one support including talk sessions. The point of these talks is to help you get going. Momentum is everything

How You Benefit

The game of building a business empire is ultimately a team sport. As your portfolio expands you will slowly recruit experts to help you run and grow it. Most billionaires have a number of centi-millionaires, if not fellow billionaires, on their teams. Specifically, The Tycoon Playbook does three extremely important things:

1) It provides you with the black book of tactics and tricks for getting into the game when it’s just you, a small grubstake, and your ambition.

2) It sets you up to be the quarterback of the team who calls the plays but relies on specialists for help to carry them out.

3) It serves as the booster rocket that lifts you off the ground and gets you into the tycoon game.

Who dares, wins. – SAS Regimental motto

Fortune favors the brave. – Virgil

Start today. There’s not a moment to waste in this life. Each decade of it goes by faster and faster.

Or find out even more about the course contents.

One Response to Tycoon Playbook Breakdown