How to Buy a Business: Buying Your Competitors

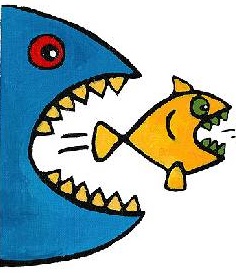

Most small businesses struggle with excruciatingly slow growth because after the first year or so of operations during which they attracted the market’s low-hanging fruit. Once this segment has been tapped the situation turns into one of trench warfare where they are fighting for new customers one at a time with competitors. The costs of this strategy can be high while the payoffs are low.

One way to break out of this demoralizing situation is to buy up competitors to acquire their customer base at closing.

Easier Financing Acquisition Financing

Here’s one of the main reasons to consider this growth strategy. It’s normally easier to secure funding to expand in this manner than it is to attract funding for a startup. Let’s take a look at why this is. Well, in this scenario you already have a business in the same industry and market as your target. It goes without saying that you then also have relevant experience in running the same type of business. Additionally, your company has existing cash flow and assets that can be leveraged to help finance the acquisition. Finally, the lender sees that the acquisition will add a significant new customer base to your business.

This is normally an attractive scenario to the lenders. About the only thing that will scare them off is if you or your company has a bad credit history. But let’s assume for the sake of the example that it’s good if not excellent. In that case, you should seriously consider acquisitions as part of your growth strategy.

A lot business owners make it their main growth strategy after they have completed a couple of deals and experience the quick payoffs from doubling their customer base with the stroke a of pen at closing.

Why do so few entrepreneurs and small business owners adopt this growth strategy? I put it down to a fear of the unknown. They convince themselves that it’s far more complex than it has to be. The Tycoon Playbook offers systems to follow for finding acquisition candidates, negotiating the deal, financing it, and then increasing its value.

Leave a Reply